Taking payments

In this article:

- How to use Tap to Pay on iPhone for your business?

- How do I take a payment/make a sale with Tap to Pay on iPhone with NatWest Tap to Pay?

- Do I need an internet connection?

- How do I know if the customer's payment card is contactless?

- What if a contactless payment card is not being read?

- What do I do if the payment requires the customer to enter a PIN code?

- How do I turn on accessibility options for PIN entry?

- What should I do if I don’t receive my daily settlement?

- Where are the payments I accept with NatWest Tap to Pay deposited?

- Will using Tap to Pay on iPhone with NatWest Tap to Pay affect the battery life of my device?

How to use Tap to Pay on iPhone for your business?

Merchants can now easily accept contactless payments with just an iPhone. With Tap to Pay on iPhone and NatWest Tap to Pay, you can accept in-person, contactless payments, right on your iPhone — from physical debit and credit cards, to Apple Pay and other digital wallets — no extra terminals or hardware needed. It’s easy, secure, and private

No monthly hire or PCI fees for Tap to Pay. Transaction fees apply. Users may be charged for data usage by their network operator. Available on iPhone XS or later with iOS 16.4 or later. Subject to Tyl eligibility criteria and terms and conditions.

Tap to Pay on iPhone requires a supported payment app and the latest version of iOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install. Some contactless cards may not be accepted by your payment app. Transaction limits may apply. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC. Tap to Pay on iPhone is not available in all markets. View Tap to Pay on iPhone countries and regions.

Contactless payment cards

Accept contactless debit and credit cards with Tap to Pay on iPhone. To confirm if your customer has a contactless card, look for the EMV® Contactless Indicator on the back or the front of the card.

To accept a contactless card, present your iPhone to the customer and ask the customer to hold their card horizontally on the tap area for a few seconds until done.

Apple Pay on iPhone

To accept Apple Pay, present your iPhone to the customer and ask the customer to hold their iPhone near the tap area until done.

Apple Pay on Apple Watch

To accept Apple Pay on Apple Watch, present your iPhone to the customer and ask the customer to hold their Apple Watch near the tap area until done.

Other digital wallets and wearables

With Tap to Pay on iPhone, merchants can also accept payments from other digital wallets and wearables that enable contactless transactions.

To accept payments from these devices, ask the customer to hold the paying device near the tap area of your iPhone until done.

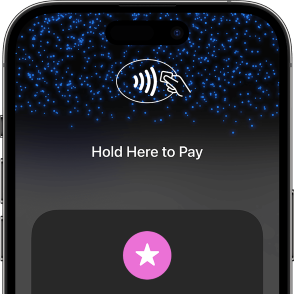

PIN entry

In iOS 16.7 or later, merchants can use Tap to Pay on iPhone to accept contactless payments that require customers to securely enter a PIN to confirm a payment.

The PIN entry screen is automatically prompted based on the customer’s card, transaction amount and merchant service provider configuration.

Accessibility options

Merchants can also enable the pin entry accessibility mode for customers that need it by tapping “Accessibility Options” on the PIN screen. The Accessible PIN entry mode will read out the instructions over the iPhone speaker to the customer. Reference instructions in text are also provided on-screen for the merchant.

How do I take a payment/make a sale with Tap to Pay on iPhone with NatWest Tap to Pay?

- Open the Tap to Pay on iPhone with NatWest Tap to Pay.

- Click on 'Tap to Pay on iPhone' option.

- Enter the amount.

- Press 'Confirm'.

- If you've enabled the Tip/Gratuity function (if not, skip this point), you can now enter the tip either as an amount or choose a percentage. Once you're happy with the amount, tap 'Confirm'.

- The contactless tap icon and the amount will appear on screen. Show this to the customer, and have them tap and hold their payment card (or device) on front of your iPhone where it reads 'Hold here to pay' (where the NFC sensor is).

- Once the card is read successfully, the screen will display a 'Done' message.

- Then it will be followed by a 'Payment is successful' message and give you the option of sending the e-receipt via email, SMS or QR code to your customer.

Please refer to the NatWest Tap to Pay App user guide for more details.

Do I need an internet connection?

Yes, in order to use Tap to Pay on iPhone with NatWest Tap to Pay, you’ll need a Wi-Fi or cellular data (3G or better) internet connection

How do I know if the customer's payment card is contactless?

The good news is that the majority of UK cards are now contactless, but you can also look for the EMV Contactless logo on the front or back of their card.

What if a contactless payment card is not being read?

The performance of contactless cards can vary based on the card design, such as the card material or the location of the antenna. As a result, some cards connect more easily than others.

Try the following to ensure a successful card read:

- First, ask the customer to hold their contactless payment card directly on the device with the chip on the left side and the longer side of the card lined up with the edge of the tap area for several seconds.

- If the card still doesn't read, ask the customer to slide the card to centre the chip directly over the notch on the device.

- If the contactless card remains unread without any feedback from the interface, the card might have a damaged antenna or might not work with contactless payments.

What do I do if the payment requires the customer to enter a PIN code?

The need to enter a PIN code can be triggered if:

- the payment exceeds the contactless limit (currently £100 in the UK)

- the card issuer (such as their bank) requires additional security from the cardholder

If a PIN is required and your customer is paying with a card that supports online PIN, a PIN entry screen will appear on your iPhone. The customer can enter their PIN on your iPhone to complete the payment.

If the customer’s card doesn’t support online PIN (and requires it to be inserted into a reader), ask if the customer has an alternative contactless card or digital wallet. You can then continue the transaction using Tap to Pay on iPhone.

If the customer does not have an alternative contactless card or digital wallet, then you will be prompted to send them a payment link via email or display a QR code from the app. When they open the link or scan the QR code, they can pay directly from their banking app on their own phone.

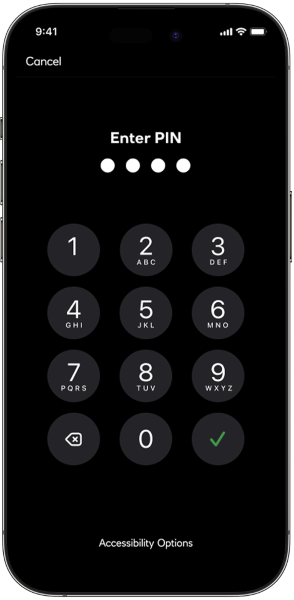

How do I turn on accessibility options for PIN entry?

From the PIN entry screen, tap Accessibility Options to turn on the accessibility mode for PIN entry.

When the accessibility mode is on, the device reads out loud the following instructions for PIN entry:

- Tap once for 1, tap twice for 2, and so on. Tap ten times for 0.

- Pause between taps for each digit. The device plays a sound to confirm entry for each digit.

- Swipe right with two fingers to confirm the PIN.

- Swipe left with two fingers to delete the last PIN digit entered.

- Swipe down with two fingers to cancel the payment.

- Swipe up with two fingers to read out loud the number of PIN digits entered.

- You can use the side buttons on your iPhone to adjust the volume as needed.

- To turn off the accessibility mode, tap Turn Off Accessibility Options.

- PIN entry times out after 5 minutes. The accessibility mode turns off automatically when the Tap to Pay on iPhone interface times out or is dismissed.

What should I do if I don’t receive my daily settlement?

You should get your daily settlement by the end of the next business day after the transactions took place. Occasionally there'll be delays, for example if a customer's raised a dispute or asked for a refund. If your settlement hasn't landed in your account, give us a call on 0345 901 0001 and choose option 3, then option 2. We'll help you get it sorted.

Where are the payments I accept with NatWest Tap to Pay deposited?

NatWest Tap to Pay is part of your Tyl suite of payment services and works in the same way as our other ways to be paid (card readers, online, phone payments, and so on). So, your NatWest Tap to Pay sales all go to your Tyl account and are settled (paid) into your nominated bank account the next business day.

Will using Tap to Pay on iPhone with NatWest Tap to Pay affect the battery life of my device?

No. Tap to Pay on iPhone with NatWest Tap to Pay won't have a noticeable impact on battery life.