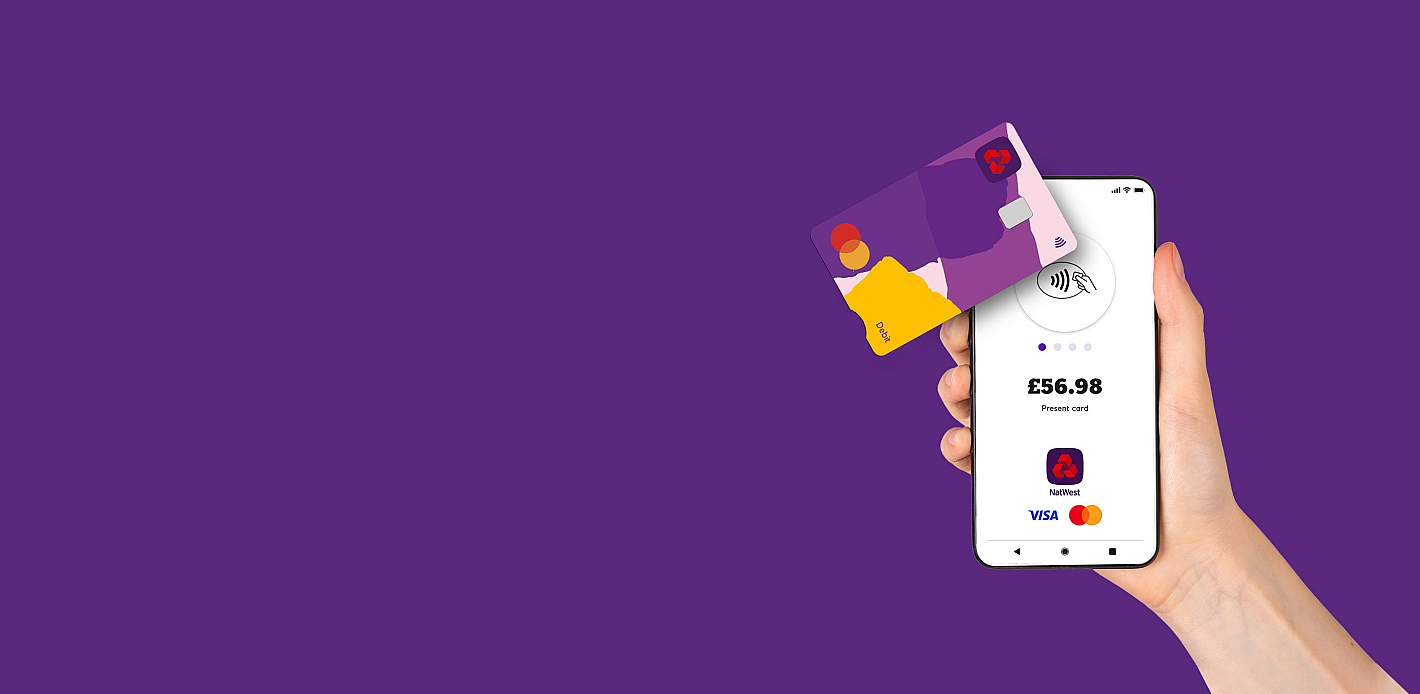

Take card payments with just your phone

Say hello to the latest innovation in card payments with NatWest Tap to Pay. Accept all types of in-person, contactless payments on your smartphone or Android tablet. No card machines or extra hardware needed. It’s easy, secure and private.

Tap to Pay comes with a flexible plan. You can end it any time with 1 month's notice.

No monthly hire or PCI fees for Tap to Pay. Transaction fees apply. Users may be charged for data usage by their network operator. Available on Android OS 11 or later with Google Services and NFC. Subject to Tyl eligibility criteria and terms and conditions.

Contactless payments on tap

Taking care of your worries

No card machine to rent or buy

Why NatWest Tap to Pay on Android?

Get the app for free

No rental costs or hidden charges, just a transaction fee (other fees may apply).

Make sales wherever you go

As long as your smartphone or tablet can connect to data, you can be taking contactless payments.

Looking to reduce costs?

8/10 customers could save on transaction fees when switching to Tyl*.

*Savings based on customers looking to switch from various providers to Tyl between Jan 2025 to March 2025. Your existing provider may charge an exit fee. Average savings not inclusive of introductory offers or any exit fees you may have been charged. Additional fees may apply for data usage or app downloads. Tyl eligibility criteria, terms, conditions and fees apply.

Find out all you need to know about NatWest Tap to Pay in our handy user guide.

Get started with Tap to Pay on Android

New to Tyl by NatWest?

To use NatWest Tap to Pay on Android, you’ll need to join Tyl by NatWest. If you haven’t already chatted to our team about joining, simply fill in the form give us a call on 0161 605 6626, or 18001 0345 901 001 for Relay UK and we’ll handle the rest.

Once your Tyl account is approved, we’ll send you your NatWest Tap to Pay login details and a link to download the app. Easy.

Already a Tyl customer?

Add NatWest Tap to Pay alongside your existing card machine(s). Simply give us a call on 0345 901 0001 or 18001 0345 901 001 for Relay UK and have your Merchant ID number to hand.

Once we apply these changes to your account, we'll send you your NatWest Tap to Pay login details and a link to download the app. Easy.

Tap to Pay on Android FAQs

What is NatWest Tap to Pay on Android?

NatWest Tap to Pay on Android allows merchants to accept card payments directly on your NFC enabled phone or devices without the need for any additional software, it uses a revolutionary contactless technology.

Find out all you need to know about NatWest Tap to Pay in our handy user guide.

I’m a sole trader and I don’t have a registered business number. Can I still apply for Tap to Pay on Android?

Yes, we’d love you to join the Tyl family. We’ll just need to see some additional documentation to process your application and check everything is in order.

Please have the following documents ready to provide after you've submitted your application:

- A copy of a recent utility bill in your trading name (e.g. phone, internet, gas, electricity, water)

- A copy of your VAT registration (if applicable)

- A copy of your business accounts or tax return (if applicable)

- Previous 6 months personal/business bank account statements

- A copy of a current Public Liability or Personal Indemnity insurance policy

- Confirmation of Regulatory Body or Membership of Professional/Trade Association (If applicable)

Note: If you do have a registered business number because you are a limited company or Limited Partnership, you don’t need to provide the above additional documents.

What payment types can I accept with NatWest Tap to Pay on Android?

With NatWest Tap to Pay on Android, you can accept in-person contactless payments right on your iPhone including credit/debit cards and digital wallets such as Apple Pay or Google Pay.

Tyl by NatWest currently accepts Mastercard, Visa and Discover® Global Network. Acceptance of American Express is expected soon.

Is there a fee for using Tap to Pay on Android?

The NatWest Tap to Pay app is currently free to download and use (standard Tyl fees, including transaction fees, apply).

Is Tap to Pay safe?

Yes. Security is very important at Tyl. Here are some ways we protect you and your business:

Encryption

Every time a Tap to Pay payment is made, the encryption changes, making it extremely difficult for a hacker to take advantage. Even if they manage to decipher a code, it’ll be too late as it’s only valid for one transaction.

Tokenisation

When a contactless payment is made, an algorithm generates a unique random value, which replaces your customer’s primary account number. The value, also called a token, passes safely through the internet, without exposing the customer’s credit card details.

Two-factor authentication

Apple Pay and many other mobile payment methods ask you to set up two-factor authentication to verify each transaction with a Face ID, PIN, or fingerprint. So, even if your phone is lost or stolen, there’s no way someone else can use it for payment.

What if the Tap to Pay payment requests a PIN number?

The need to enter a PIN code can be triggered if:

- the payment exceeds the contactless limit (currently £100 in the UK)

- the card issuer (such as their bank) requires additional security from the cardholder

NatWest Tap to Pay and Tyl support PIN entry in several ways:

- If your customer pays with a card that supports online PIN, a PIN entry screen will appear on your phone, where the customer can enter their code.

- If your customer is paying with a card thatmust be inserted into a reader, ask your customer if they have another card or a mobile wallet (Apple Pay, Google Wallet or Samsung Pay) to make the payment.

- If you have another Tyl card reader, you can use this to complete the payment instead.