Our Pricing and Fees

Our fees are based upon the size and type of your business. To be eligible for Tyl your business must be based and trading in the UK and you must be over 18. Criteria apply.

What is your annual card payment value?

Just combine the relevant transaction fee of our latest products and services (monthly charge) and you’re ready to go

- 1.39% + 5p fee per transaction Personal cards

- 1.99% + 5p fee per transaction All other cards

- Your choice of card machine

- Online payment gateway Special offer^

Things you are charged for

Two clear prices for smaller businesses

For transactions using UK or European personal cards – these are debit or credit cards connected to a person’s private bank or credit account (not a business account) – the fee you’ll pay is 1.39% of the transaction value, plus a 5p authorisation fee.

So, on a £10 sale, your Tyl account will be charged 19p (14p + 5p). Our data shows that UK small businesses mostly take sales with these cards, so we’ve made that the cheaper of the two rates, to hopefully keep your costs down.

For transactions using other cards (such as business account cards or international personal debit/credit cards), the fee you’ll pay is 1.99% plus a 5p authorisation fee. So, for a £10 sale, your Tyl account will be charged 25p (20p + 5p).

American Express (Amex) does things slightly differently with rates that vary by industry. If you accept American Express (Amex), just let us know and we’ll build that into our quote.

Authorisation fees

We charge a flat 5p per transaction as an authorisation fee (included above, so “1.39%/1.99% + 5p”). Authorisation fees are charged at a flat fee for every card transaction you take through Tyl. Authorisation fees are collected as part of your monthly direct debit and will cover any transactions/authorisations processed in the invoice period. We don’t charge a fee for processing refunds.

^Special offer: No monthly fees on e-commerce gateway for 12 months. Usually £14.95+VAT per month. Terms, conditions and eligibility apply#.

#Offer available for new and existing Tyl by NatWest customers who do not currently have a payment gateway with Tyl. Offer ends 30th June 2025. We’ll be in touch to let you know your options after 12 months (previously priced at £14.95+VAT per month on a monthly subscription basis). The Payment gateway comprises of online, telephone and pay-by-link payment functionality. Additional fees may apply for data usage or app downloads. Tyl eligibility criteria, terms and conditions and fees apply.

Things you aren’t charged for

No minimum charges and no hidden extras

It really is as simple as that. There’s no minimum monthly service charge and no extra charge for:

- Card-not-present payments (such as sales over-the-phone).

- Payments made online or using a payment link.

- Cancelling your contract.

- International card payments.

- Refunds.

Devices and services for every business

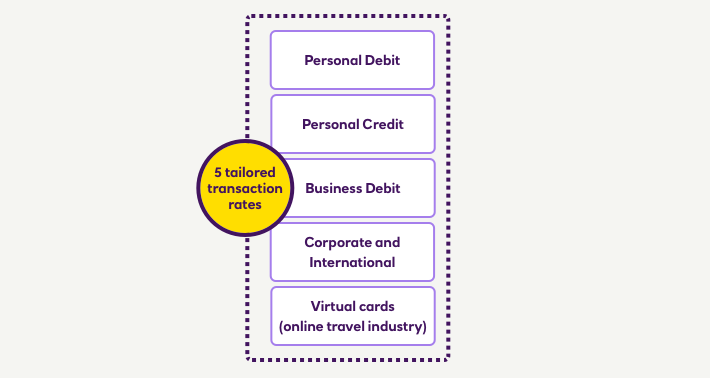

A simple recipe for saving every month. Your monthly invoice is made up of just five things, and while we can’t show you all the details we can give you a good idea of what to expect.

- 5 tailored transaction rates

- Your choice of card machine

- Online payment gateway Special offer^

- Authorisation fees

Things you are charged for

Our rates

Our payment rates are charged as a % of the value of each transaction. We use 5 simple price categories for your Mastercard, Visa and Discover® Global Network card payment rates (some of our competitors use up to 170). These are charged as a % of the value of each transaction.

American Express

American Express does things slightly differently with rates that vary by industry. If you accept Amex, just let us know and we’ll build that into our quote.

Authorisation fees

As with other providers, there is a flat fee (in pence) each time a payment transaction is authorised or declined.

PCI DSS fees

You’ll only pay PCI DSS fees if we determine that you’re subject to additional requirements. In this case, you’ll be provided with Safe Pay, which you find more information here.

All payments using our terminals, NatWest Tap to Pay or Payment Gateways are securely encrypted using PCI SSC-approved Point-to-Point Encryption (P2PE) by default.

^Special offer: No monthly fees on e-commerce gateway for 12 months. Usually £14.95+VAT per month. Terms, conditions and eligibility apply#.

Special offer for high card turnover

If your business takes more than £100k-a-year in card payments, you could get free card machine hire fees for 6 months.*

*New Tyl by NatWest customers who take more than £100k in card payments a year only. This will be based on the estimated annual payment value provided by the customer. We reserve the right to reclaim the promotion value should the customer take less than £100k in card payments in their first year with Tyl By NatWest. Promotion valid from 1st February 2025 to 31st May 2025. Minimum 12-month contract. After 6 months standard hire fees per device will apply. Additional fees may apply for data usage or app downloads. Early cancellation fees may apply, eligibility criteria and fees apply.

#Offer available for new and existing Tyl by NatWest customers who do not currently have a payment gateway with Tyl. Offer ends 30th June 2025. We’ll be in touch to let you know your options after 12 months (previously priced at £14.95+VAT per month on a monthly subscription basis). The Payment gateway comprises of online, telephone and pay-by-link payment functionality. Additional fees may apply for data usage or app downloads. Tyl eligibility criteria, terms and conditions and fees apply.

Things you aren’t charged for

Surcharges

None. Zero. Zip. Not a bean. Tyl does not charge extra for payments taken over the phone or through your website, or for international card payments. You’re welcome.

Refunds

No fees here, either.

Devices and services for every business

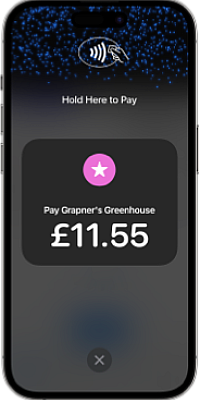

NatWest Tap to Pay

Take card payments with your iPhone and Android phone.

Online payments gateway

No monthly fees on e-commerce gateway for 12 months. Usually £14.95+VAT per month. Terms, conditions and eligibility apply*.

This essential functionality gives you the power to quickly and easily accept payments through your website, over the phone or by email (pay-by-link).

Offer available for new and existing Tyl by NatWest customers who do not currently have a payment gateway with Tyl. Offer ends 30th June 2025. We’ll be in touch to let you know your options after 12 months (previously priced at £14.95+VAT per month on a monthly subscription basis). The Payment gateway comprises of online, telephone and pay-by-link payment functionality. Additional fees may apply for data usage or app downloads. Tyl eligibility criteria, terms and conditions and fees apply.